As I've been working on my book on bankruptcy this summer, I've been going back through the various hypotheses that have been advanced for the rise in American bankruptcy filings in the 1980s and 1990s. One hypothesis was that advanced in The Two-Income Trap: Why Middle Class Mothers and Fathers are Going Broke by Professor Elizabeth Warren and Amelia Warren Tyagi.

Warren & Tyagi's argument can be easily summarized. They focus on the rise in the number of households with two parents working as an indication of economic distress. Conventional economic theory would indicate that one benefit of having a second wage-earner is that it will make the family more resilient to a financial setback or loss of job than a traditional family with only one wage-earner. Families today, unlike those a generation ago, can save the second earner's income as precautionary savings, thereby making it easier to withstand a setback.

Warren and Tyagi disagree with this conventional economic approach.

[To continue reading hidden text click "show"]

They argue that contrary to standard economic theory, the influx of a second worker has actually made a family more susceptible to economic setback. The argument is a bit opaque, but it seems to rest on the idea that recent decades have seen an excessive "bidding war" for housing, as families compete to get their children into preferred school districts. This bidding war for housing has, in turn, driven mothers from the home into the workplace, in order to earn sufficient income to pay the mortgage on high-priced homes. In turn, this increased female workforce participation has given rise to a whole new host of expenses, such as additional cars and child care expenses. In the end, Warren and Tyagi argue, the family is no more financially stable or well-off, because now both incomes are needed to pay for the house, as well as the necessary expenses associated with maintaining a two-income family, such as an additional car to get to work and daycare. Warren and Tyagi have dubbed this phenomenon the "two-income trap," which, at its core, is said to be driven by the rapid appreciation in housing prices. Because houses in good neighborhoods are expensive, thus in order to pay the mortgage, mom goes to work to supplement dad's income.

So although the second job brings in new income, it brings with it a whole new set of expenses, many of which are supposedly dedicated to sustaining mom's employment, such as child care expenses and another car. So the family ends up even more highly leveraged than previously and with a higher family income and two wage-earners, but counterintuitively, more vulnerable to financial setback than previously. Thus, there is sort of a prisoner's dilemma here--all families would be better off if they could commit to having only one wage-earner in the workforce, thereby keeping down the price of necessities, and especially housing, the alleged trigger for this arms'-race, and send the second worker into the workforce only in times of necessity. Yet, no family can afford to sit it out, because otherwise it will be left behind. So off they trudge, held hostage to the house and the ancillary expenses needed to maintain it.

Numerous questions could be raised about the theoretical assumptions that underlie their analysis, such as the unproven assertion that the rise in two-working-parent families is caused primarily by a housing bidding war. Scholars have provided several plausible explanations for the rise in two-working-parent families, such as smaller family size (which reduces the economies of scale in one parent specializing in child-rearing) or the philosophical and intellectula revolution of feminism, which simply empowered women who wanted to work to do so. Warren and Tyagi do not discuss these competing theories or why their theory is more accurate than these alternatives.

There is also the obvious questions of causation--having more income surely causes at least some families to increase their expenses by buying larger houses, houses in more expensive neighborhoods, or newer and more expensive cars than they might otherwise. For instance, data from the Survey of Consumer Finances suggests that households were buying more expensive cars around 2000--the time period Warren and Tyagi study--than in the past, especially more expensive SUVs and luxury cars. See Ana M. Aizcorbe et al., Recent Changes in U.S. Family Finances: Evidence from the 1998 and 2001 Survey of Consumer Finances, 89 FED. RES. BULL. 1, 17 (2003). To a substantial extent, this decision to buy more expensive cars or more expensive houses was because households were wealthier than before because of massive increases in the stock market and home equity, and consumers borrowed against that wealth to increase their consumption. In addition, the rise in home ownership rates between the 1970s and today has added more highly-leveraged borrowers into the measurement pool, thereby tending to increase the measured housing obligation for the average family as well by moving them from renting to owning (also, of course, giving them an extremely valuable wealth accumulation asset). The growth in home ownership in the past decade is charted here.

But let's aside detailed discussion of the questions of theory and focus on whether the hypothesis is valid as an empirical matter.

But despite all of these caveats, we will still treat increases in mortgage and automobile expenses as exogenous and causal variables. Warren and Tiyagi's argument rests on a stylized example of the situation facing a "typical" middle class family today versus a generation ago (I apologize for the length of the excerpt, but the book itself presents the core data in a discursive manner). All figures are inflation adjusted:

We offer two examples.

We begin with Tom and Susan, representatives of the average middle-class family of a generation ago [early 1970s]. Tom works full-time, earning $38,700, the median income for a fully employed man in 1973, while Susan stays at home to care for the house and children. Tom and Susan have the typical two children, one in grade school and a three-year-old who stays home with Susan. The family buys health insurance through Tom's job, to which they contribute $1,030 a year--the average amount spent by an insured family that made at least some contribution to the cost of a private insurance policy. They own an average home in an average family neighborhood--costing them $5,310 a year in mortgage payments. Shopping is within walking distance, so the family owns just one car, on which it spends $5,140 a year for car payments, maintenance, gas, and repairs. And like all good citizens, they pay their taxes, which claim about 24 percent of Tom's income. Once all the taxes, mortgage payments, and other fixed expenses are paid, Tom and Susan are left with $17,834 in discretionary income (inflation adjusted), or about 46 percent of Tom's pretax paycheck. They aren't rich, but they have nearly $1,500 a month to cover food, clothing, utilities, and anything else they might need.

So how does our 1973 couple compare with Justin and Kimberly, the modern-day version of the traditional family? Like Tom, Justin is an average earner, bringing home $39,000 in 2000--not even 1 percent more than his counterpart of a generation ago. But there is one big difference: Thanks to Kimberly's full-time salary, the family's combined income is $67,800--a whopping 75 percent higher than the household income for Tom and Susan. A quick look at their income statement shows how the modern dual-income couple has sailed past their single-income counterpart of a generation ago.

So where did all that money go? Like Tom and Susan bought an average home, but today that three-bedroom-two-bath ranch costs a lot more. Their annual mortgage payments are nearly $9,000. The older child still goes to the public elementary school, but after school and during summer vacations he goes to day care, at an average yearly cost of $4,350. The younger child attends a full-time preschool/day care program, which costs the family $5,320 a year. With Kimberly at work, the second car is a must, so the family spends more than $8,000 a year on its two vehicles. Health insurance is another must, and even with Justin's employer picking up a big share of the cost, insurance takes $1,650 from the couple's paychecks. Taxes also take their toll. Thanks in part to Kimberly's extra income, the family has been bumped into a higher bracket, and the government takes 33 percent of the family's money. So where does that leave Justin and Kimberly after these basic expenses are deducted? With $17,045--about $800 less than Tom and Susan, who were getting by on just one income.

Reading that excerpt, I thought, "Hmm, that's confusing. I wonder why they listed the actual dollar values for all of the other expenses, but the 'percentage' of income spent on taxes. That makes it difficult to compare to make an apples to apples comparison of the actual tax burdens between the two periods." Presenting it in this manner is even more confusing because the authors then go on to implicitly convert tax obligations to dollar values in order to calculate the total amount of the families' budgets dedicated to aggregate "fixed costs" versus "discretionary spending," concluding thtat the 2000s couple has less left over for discretionary spending than the prior generation. Yet, although they report the actual dollar values for everything else, in an apparent oversight, they never actually report the actual dollar figures for the tax expenditures in the two periods.

So I got out my handy calculator and calculated what the indicated percentage of taxes translates into in terms of actual dollars paid in taxes. In turns out that for the 1970s family, paying 24% of its income in taxes works out to be $9,288. And for the 2000s family, paying 33% of its income (a higher rate presumably because of progressivity hitting the second wage-earners income) in taxes works out to be $22,374.

Thus, taxes increase in the example by $13,086. By contrast, annual mortgage obligations increased by only $3690 and automobile obligations by $2860 and health insurance $620. Those increases are not trivial, but they are swamped by the increase in tax obligations. Too put this in perspective, the increase in tax obligations is over three times as large as the increase in the mortgage (the supposed driver of the "two income trap") and about double the increase in the combined obligations of mortgage and automobile payments. This also leaves aside the peculiarity that the 2000s family is paying $9670 in new child care and $2860 in new automobile expenses supposedly to meet a $3690 increase in mortgage expenses, the supposed driver of the model.

Indeed, because of this huge increase in the tax bite, the percentage of family income dedicated to payments for health insurance, mortgage, and automobiles actually fell between the two periods. Consider the following charts taken from my article "An Economic Analysis of the Consumer Bankruptcy Crisis" (I used the actual dollars to calculate this, which because of rounding errors lead to the percentages being a bit off):

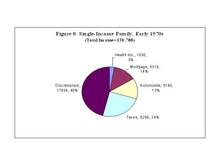

First, consider the "average family" of the 1970s:

As can be seen, for the 1970s family, health insurance is 3% of income, mortgage payments 14%, and automobile expenses 13% of income.

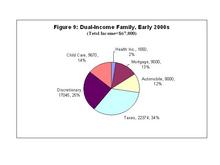

Compare the "average family" of the 2000s:

As can readily be seen, expenses for health insurance, mortgage, and automobile, have actually declined as a percentage of the household budget. Child care is a new expense. But even this new expenditure is about a quarter less than the increase in taxes. Moreover, unlike new taxes and the child care expenses incurred to pay them, increases in the cost of housing and automobiles are offset by increases in the value of real and personal property as household assets that are acquired in exchange.

Overall, the typical family in the 2000s pays substantially more in taxes than in their mortgage, automobile expenses, and health insurance costs combined. And the growth in the tax obligation between the two periods is substantially greater the growth in mortgage, automobile expenses, and health insurance costs combined. And note, this is using the data taken directly from Warren and Tiyagi's book.

It is not clear what to make of all of this, except that it is hard to see how this confirms the central hypothesis of "The Two-Income Trap" that "necessary" expenses such as mortgage, car payments, and health insurance are the primary draing on the modern family's budget. And again, this unrealistically assumes that all increased spending on houses and cars is exogenously determined, ignoring the possibility that an increase in income leads to an endogenous decision by some households to increase their expenditures on items such as houses and cars.

Instead, Warren and Tiyagi's data, point to the conclusion that the obvious problem for this "typical" American family appears to be an extremely high tax burden caused primarily by the progressive nature of the income tax that hits families with two working adults by kicking them into higher marginal tax rates.

This conclusion is obscured by the confusing way in which the data is presented in "The Two-Income Trap." Whereas the book presents all of the other figures in terms of dollar values, expenditures on taxes is presented in terms of percentages. This stylistic decision unfortunately makes it difficult ot recognize that this increase in taxes is the primary factor causing the drop in "discretionary income" between the two time periods. It is not obvious why exactly the authors presented only this one particular entry in terms of percentages rather than actual dollars, which obscures what is going on by making it more difficult to understand exactly how much of the family budget was allocated to paying taxes versus these other expenditures. And even though the actual dollar value for taxes is later used to calculate the fixed and discretionary portions of the family budget, that figure is not reported anywhere in the book itself. Converting percentages to dollars, however, it is evident that the percentage of income dedicated to tax payments is by far the biggest difference between the "typical" family of the 1970s versus that of the 2000s. In the end, this confusing presentation seems to have led to overall confusion about the lessons of the book.

Finally, this confusion about the underlying dynamic also leads to confusion about policy recommendations. In particular, although Warren and Tyagi do not make this argument, it would seem to follow that one logical policy implication of this analysis would be to support a lower and flatter marginal tax rate. This would reduce the household tax burden and increase available discretionary income.

Related Posts (on one page):

- Robert Frank Falls For the Two-Income Trap:

- An Even More Confusing Presentation of the Two-Income Trap and Taxes:

- The Two-Income Tax Trap:

- Evaluating The Two-Income Trap Hypothesis: