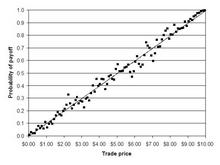

From the comments, it seems that some readers would find empirical evidence more persuasive than theoretical arguments. Consider the figure below. It aggregates a total of 145,388 trades on Major League Baseball games in 2005. Each contract would pay off $10.00 if the specified team won the game.

The x-axis represents different transaction prices, and the y-axis shows, for all trades at that price or up to 10 cents higher, the probability that the team in fact won the game. Note that the points conform fairly closely to a 45-degree line.

This doesn't prove that prediction markets are perfect predictors. Maybe some other prediction mechanism could be calibrated in this way yet have more predictions toward the ends of the probability continuum. A savvy trader might still be able to profit by running statistical tests to find systematic biases in prices.

And of course, we can't necessarily extrapolate from baseball to other types of forecasting environments. Some organizations (like insurance companies) may already have very sophisticated procedures for developing probabilistic forecasts, and this doesn't prove that prediction markets would enhance those.

Nonetheless, they ought to be good enough for government work. And most corporate work too.