|

Those Who Favor Income Redistribution Are Less Happy and Less Generous.--

Last fall and winter, I circulated a paper on the relationship of people's views on income redistribution and capitalism to traditional racism and to intolerance for unpopular groups. I presented it to Gary Becker's and Dick Posner's Rational Choice Workshop at the University of Chicago and to the Law, Economics, and Organization Workshop at Yale.

With the publication of Arthur C. Brooks' new book Who Really Cares (tip for the news story to Instapundit), which presents data showing that conservatives tend to be more generous than non-conservatives, I decided to put a full PDF copy of my paper on SSRN. It appears that our analyses directly overlap only slightly, though they are certainly generally complementary.

In the field of social psychology, it is commonly believed that people support capitalism and oppose greater income redistribution because they are racist or want to dominate other people or groups. Indeed, a study of college students in the United States and secondary students in Sweden found that attitudes supporting capitalism were positively associated with racism and an orientation toward social dominance (Sidanius & Pratto, 1993). In my draft article I expand and test this thesis using 16 nationally representative General Social Surveys conducted by the National Opinion Research Center between 1980 and 2004.

In later posts, I will discuss my main results, but in this post I want to confirm one of Brooks' findings (in chapter 3 of his book)--those who oppose greater government income redistribution tend to give much more to charity. What follows is a shortened version of one small section of my paper (the paper includes relevant charts).

In the 1996 General Social Survey, about 900 respondents were asked: "On how many days in the last 7 days, have you felt . . ." happy, sad, lonely, calm, anxious, angry, tense and angry, and twelve other emotions. These results were compared to the results on an income redistribution question:

EQWLTH: "Some people think that the government in Washington ought to reduce the income differences between the rich and the poor . . . . Think of a score of 1 as meaning that the government ought to reduce the income differences between rich and poor, and a score of 7 meaning that the government should not concern itself with reducing income differences."

Strong redistributionists (category 1) reported that they "worried a lot about little things" on about one more day a week than strong anti-redistributionists (category 7). They also reported being "lonely" and being unable to "shake the blues" on about an additional day a week. Strong redistributionists (category 1) also reported about one fewer day a week on which they were "happy," "contented," and "at ease."

In terms of relative odds, strong redistributionists (category 1) had about two to three times higher odds of reporting that in the prior seven days they were "angry" (2.0 times higher odds), "mad at something or someone" (1.9 times), "outraged at something somebody had done (1.9 times), sad (2.1 times), lonely (2.3 times), and unable to "shake the blues" (3.5 times). Similarly, anti-redistributionists had about two to four times higher odds of reporting being happy (3.8 times) or at ease (2.1 times). The data are consistent with redistributionists in the general public being more angry, sad, lonely, worried, and restless, and less happy, at ease, and interested in life.

Not only do redistributionists report more anger, but they report that their anger lasts longer. Further, when asked about the last time they were angry, strong redistributionists were more than twice as likely as strong opponents of leveling to admit that they responded to their anger by plotting revenge. Last, both redistributionists and anti-capitalists expressed lower overall happiness, less happy marriages, and lower satisfaction with their financial situations and with their jobs or housework.

But do these attitudes have behavioral consequences? In other words, are the data consistent with the hypothesis that anti-redistributionists are more generous or altruistic? Data from self-reports appear to support the notion that those who oppose income redistribution are somewhat more altruistic in their behavior than redistributionists. Compared to those favoring greater income redistribution, anti-redistributionists are more likely to report that they donated money to charities, religious organizations, and political candidates (p<.000000001). This hypothesized effect remains significant (p=.001) after controlling for race, gender, age, income, and education. Anti-redistributionists were also more likely to report having returned money after receiving too much change, and to have looked after plants, pets, or mail while someone was away. The one sort of altruistic behavior the redistributionists were more likely to engage in was giving money to a homeless person on the street. Thus, it appears that those who wanted the government to promote more income leveling were less likely to be generous themselves in their patterns of charitable donations and some other altruistic behaviors.

Among the blogs noting or discussing the philanthropy issue are:

Instapundit,

Powerline,

SisterToldjah,

DCNY,

Res Publica,

SpunkyHomeSchool,

BackYardConservative,

SouthernKnight,

Blogs of War,

American Conservative Daily,

Truth About Everything.

UPDATE: Below some commenters speculate that the pattern of greater donations to charity by anti-redistributionists is trivial in size or simply a function of religion. But anti-redistributionists give more to secular (non-religious) charities as well. Brooks reports (p. 56) that strong anti-redistributionists gave 12 times more money to charity than strong redistributionists, and 9 times more to secular (non-religious) causes.

In my own analysis of donation (which was simply part of a paragraph in a much longer paper), I expected to find larger donations and a greater frequency of donation for anti-redistributionists, but I expected that to disappear entirely when one controlled for income. As expected, the effect is lessened but to my surprise, it still remains statistically significant.

2D UPDATE: The insightful Ralph Luker at Cliopatria briefly comments:

Arthur C. Brooks' new book, Who Really Cares: The Surprising Truth About Compassionate Conservatism, is likely to be controversial and his data needs to be tested. But would it be surprising if rightists placed greater trust in private initiatives to do what leftists expect of government?

More at:

Mirror of Justice (Greg Sisk),

Wizbang,

Political Pit Bull.

What Arthur Brooks's "Who Really Cares" is About.--

I have been working through Arthur Brooks' new book, Who Really Cares: America's Charity Divide; Who Gives, Who Doesn't, and Why It Matters. Some parts I've read carefully, while some parts I've merely skimmed.

On balance, I think it is a good book, but that doesn't mean that I don't have some problems with the argument. In this post I will briefly describe some of the book's main contentions.

The book argues, among other things:

(Ch. 1) Conservatives give more money to charities than liberals.

(Ch. 2) Religion is involved, even accounting for more giving to secular institutions.

(Ch. 3) Redistributionists are less generous personally than anti-redistributionists.

(Ch. 4) Government intervention (including welfare) suppresses giving.

(Ch. 5) Families with children are more generous and that patterns of giving are taught to children.

(Ch. 6) Generally, Americans are more generous than people in other countries, in donating both money and time.

(Ch.7) Charity has great benefits for the giver (or as the chapter is extravagantly titled: "Charity Makes You Healthy, Happy, and Rich").

(Ch.8) Charity can be encouraged, and should be encouraged, by better laws, policies, and practices.

(Appendix)The book ends with a 24 page appendix summarizing the main databases used and providing tables showing some of Brooks' regression and probit analyses.

Written for a general educated audience, the book is quite accessible. Even to someone like me who had discovered some of the patterns that Brooks identifies, I found much that I hadn't seen or thought about. He is much more sanguine about the good that charitable giving does than I would even dream of being. And I hadn't considered the benefits to the giver (including developing social capital) that Brooks so enthusiastically endorses. But then, my research focuses more on attitudes, than on self-reported behavior.

I liked the maps comparing the states that voted for Kerry in 2004 with the states that are below average in charitable giving (p. 23). The correlation is very close.

The comparison that starts off Chapter 2 is quite stark as well: Families in San Francisco give about the same amount to charity as families in South Dakota: $1,300. Yet the SF families have average incomes of about $80,000, compared to only about $45,000 in South Dakota.

I discuss some problems with Who Really Cares is the post immediately above this one.

Concerns About Arthur Brooks's "Who Really Cares."--

In the post immediately below, I describe some of the arguments in Arthur Brooks's, Who Really Cares: America's Charity Divide; Who Gives, Who Doesn't, and Why It Matters.

There were, however, some things that troubled me.

Although the liberal v. conservative split is the hook for the book, the data are not nearly as stark as the hype surrounding the book might indicate.

Consider this passage (pp. 21-22):

When it comes to giving or not giving, conservatives and liberals look a lot alike. Conservative people are a percentage point or two more likely to give money each year than liberal people, but a percentage point or so less likely to volunteer [citing the 2002 General Social Survey (GSS) and the 2000 Social Capital Community Benchmark Survey (SCCBS)].

But this similarity fades away when we consider average dollar amounts donated. In 2000 [citing 2000 SCCBS data], households headed by a conservative gave, on average, 30 percent more money to charity than households headed by a liberal ($1,600 to $1,227). This discrepancy is not simply an artifact of income differences; on the contrary, liberal families earned an average of 6 percent more per year than conservative families, and conservative families gave more than liberal families within every income class, from poor to middle class to rich.

I am skeptical of basing so much on the SCCBS, in large part because it reports that liberal families make more money than conservatives (it is not clear from Brooks's book whether the survey is of a representative national sample). In the 2000, 2002, and 2004 General Social Surveys, which are representative samples of the US, conservative families make $2,500 to $5,600 a year more than liberal families in each one. Although I don't have the ANES data handy, my recollection is that the economic differences between conservatives and liberals are usually in the same direction and even larger in the ANES than in the GSS. Further, in each of these 3 GSSs, the lowest income families were the political moderates, who usually made substantially less than either liberals or conservatives.

This raises another problem with Brooks' analysis: the contrast in Who Really Cares is frequently made between liberals (about 30% of the population) and conservatives (about 40% of the population), but I find that often the group that contrasts most strongly with conservatives is not liberals (who share with conservatives higher than average educations), but political moderates (about 30% of the population).

This problem comes to a head in Brooks's probit and regression models analyzing SCCBS data (pp. 192-193). After controlling for a lot of things that you might not want to control for (i.e., being religious or secular), Brooks concludes that "liberals and conservatives are not distinguishable" in whether they have made any donation in the last year. This is literally true, but he fails to note that in the model liberals give significantly more than moderates, if a traditional .05 significance level is used, while conservatives do not differ significantly from moderates. Yet in Table 6, the significance level used as a threshold for identification with an asterisk is .01, not .05, as he uses in some of the other tables. In one table (p. 197), Brooks even reports significance at the .10 level, as well as at the .05 and .01 levels.

I can't rule out the possibility that Brooks changed his reporting of the significance level so he wouldn't have to explain why, after lots and lots of controls, liberals were more likely to have made a donation than moderates, while conservatives did not differ significantly from either liberals or moderates.

Brooks's somewhat misleading reporting continues when he presents the results of the model predicting the dollar amount of donations. Brooks says that in the continuous dollar model, "conservatives are slightly (but distinguishably) more generous than liberals." (p. 192) Again, this appears to be literally true. But what the model actually shows is that liberals give significantly more money than moderates, while conservatives give significantly more than both moderates and liberals. Moderates would seem to be the ungenerous ones, not liberals.

This problem of treating liberals and conservatives (who share similar levels of education) as the outliers — when moderates often are the outliers — is a common one in conservatism research, whether that research is done by liberal or conservative researchers. Here it can make liberals look as if they are at the opposite end of the spectrum in donations from conservatives, but from the data that are presented by Brooks, it's often hard to tell whether moderates (not liberals) really are the outliers.

My first post related to Brooks's book concerned, not liberals, moderates, and conservatives, but those who favor income redistribution v. those who don't. Here the answer is more consistent: those who oppose income redistribution tend to be less racist, more tolerant of unpopular groups, happier, less vengeful, and more likely to report generous charitable donations. In most years of the GSS (but not 2004), political moderates tend to be nearly as redistributionist as liberals, so it's important not to see redistribution as a simple issue of liberals v. conservatives.

On the whole, I think that Who Really Cares is a valuable book with much sound analysis, but it appears that some of its main conclusions are based on the 2000 Social Capital Community Benchmark Survey, some of whose demographics don't appear to match national representative samples such as the GSS and ANES. And in Brooks's book, sometimes liberals are accused of being ungenerous when it appears that they may be more generous than political moderates. Generally, his otherwise strong analysis is weakened by focusing too little on what I have called the forgotten middle: moderates

THOSE WHO FAVOR INCOME REDISTRIBUTION ARE MORE LIKELY TO EXPRESS RACIST VIEWS.

Last week I posted several times on the charitable donation patterns of redistributionists, the subject of one chapter in the book Who Really Cares and a peripheral issue in a paper of mine, Testing Social Dominance: Is Support for Capitalism and Opposition to Income Redistribution Driven by Racism and Intolerance?

This week I will describe some of the main ideas in my paper on the attitudes of income redistributionists and anti-capitalists, a paper that can be downloaded in its entirety at this SSRN page.

In the field of social psychology, it is commonly believed that people support capitalism and oppose greater income redistribution because they are racist or want to dominate other people or groups. Indeed, a study of college students in the United States and secondary students in Sweden found that attitudes supporting capitalism were positively associated with racism and an orientation toward social dominance (Sidanius & Pratto, 1993, cited in my manuscript). In my manuscript I expand and test this thesis using 16 nationally representative General Social Surveys (GSS) conducted by the National Opinion Research Center between 1980 and 2004.

The GSS is the most widely used database in sociology except for the US Census and one of the most used databases in the social sciences. For a discussion of the questions I use to measure traditional racism and redistributionist attitudes, you can download my manuscript from SSRN and examine pages 16-19.

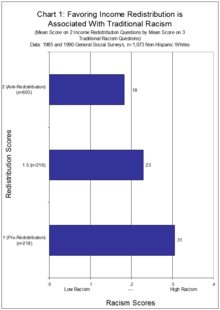

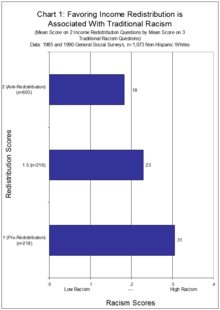

I begin by showing that respondents who express traditionally racist views (on segregation, interracial marriage, and inborn racial abilities) tend to support greater income redistribution. All nine spearman correlations between the three racism variables and the three redistribution variables are significant, with coefficients ranging from .067 to .142.

Next I make two simple scales, one combining the three racism variables into a Racism Scale and the other combining two income redistribution variables that were asked in the same GSS into a Redistribution Scale.

In Chart 1, scores on the 3-item traditional racism scale are compared to scores on the 2-item income redistribution scale. Overall, 42% of the non-Hispanic white population expressed racist responses to any of the three questions. Those who favored income redistribution also tended to express traditionally racist views. In other words, the data are consistent with the hypothesis that those who want the government to equalize incomes tend to be somewhat more traditionally racist than those who don't favor equalizing incomes.

(Click to enlarge.)

Later in the paper I present the results of full latent variable structural equation models. The latent variable traditional racism (Model 1: r=.27) predicts the latent variable income redistribution. (I also find that the preference against income redistribution is not just the result of income or education; rather, the data are consistent with racism continuing to play a small but significant role in explaining the support for income redistribution.)

The data are broadly inconsistent with the standard belief in the social psychology literature that anti-redistributionist views are positively associated with racism. The results are a problem for the academic assumption that opposing income redistribution indicates hostility toward other groups and a desire to dominate them. Indeed, many social psychologists believe that the link between opposing redistribution and social dominance is so strong and clear that opposing redistribution can be treated as a measure of social dominance orientation.

|

|