On to cap design. We've got 24 different cap variations, reflecting the dynamics in each of the 31 states that have damages caps. What is the impact of these variations on payout? Is a non-econ cap of $250k twice as strict as a cap of $500k? How should one compare the impact of a total damages cap with a non-econ cap?

To sort this issue out, we applied each of the 24 caps against the same set of tried and settled cases from Texas. This allows us to assess the comparative severity of each cap. To be sure, the impact of each cap is dictated by the mix of cases to which it is applied -- so we cannot say what the impact of any given cap will be in any given state. More bluntly, that means we're not saying that if a state adopts a particular cap, the figures in the table accurately predict the percentage impact on payouts in that state. Put another way, your mileage may vary.

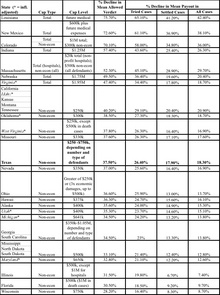

The next table lists the state caps from most to least strict, based on percentage reduction in mean allowed verdict. It also shows the predicted reduction in mean payout in tried cases, settled cases, and all cases. The ranking of caps by verdict impact is similar, but not identical, to the ranking by payout-based impact. Across all states, the predicted impact in verdicts is larger than the predicted impact on payouts in tried cases, and the predicted impact on payouts in tried cases is larger than the predicted impact in settled cases.

As this table reflects, damages caps vary widely in stringency. At the high end, Louisiana's $500k total damages cap reduces mean allowed verdicts by 76%, payouts in tried cases by 65%, and payouts in settled cases by 41%. At the low end, Wisconsin's $750k cap on non-econ damages reduces verdicts by 28%, payouts in tried cases by 16%, and payouts in settled cases by 8%. The Texas cap, which varies based on number and type of defendants, is equivalent in overall effect to a simple $336k (1988$) non-econ cap, and is thus slightly less stringent than Oklahoma's $300k cap.

Total damages caps have an especially large effect on allowed verdicts. The total damages caps in Louisiana ($500k), New Mexico ($600k), Indiana ($1.25M), Nebraska ($1.75M) and Virginia ($1.95M) have a greater impact on allowed verdicts and (less sharply) post-verdict payouts than any of the non-econ caps, even though the non-econ caps often have much lower levels. However, the Nebraska and Virginia total damages caps are comparable to a $250k non-econ cap in their effect on payouts in settled cases. The lower effect on payouts in tried cases is because the large verdicts which are affected by these total damages caps tend to receive large haircuts. The lower effect on settled cases is because settled cases tend to be smaller than tried cases.

Finally, the relationship between cap level and cap impact is complex, and depends on various features of cap design. Focusing only on cap level, a cap of $250k reduces payout across all cases by 20.9%. Increasing the cap to $350k reduces payout across all cases by 16.9%. Increasing it again to $500k reduces payout to 12.8%. A further increase to $650k reduces payout by 12.6% -- virtually the same impact as the cap of $500k.

Tomorrow, more detail on cap design, including the impact of adjusting cap level for inflation.

Related Posts (on one page):

- Damage Caps and Medical Malpractice VII

- Damage Caps and Medical Malpractice Litigation: VI

- Damage Caps and Medical Malpractice Litigation: V

- Damage Caps and Medical Malpractice Litigation: IV

- Damage Caps and Medical Malpractice Litigation: III

- Damage Caps and Medical Malpractice Litigation: II

- Damage Caps and Medical Malpractice Litigation